Tax computer depreciation calculator

Potential Tax Savings. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022.

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

For example one might suggest computer equipment depreciate over five years but if your business requires renewal every three years you can appreciate it over a shorter time.

. Gain a proven. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. You can recover some or all of your improvements by using Form 4562 to report depreciation beginning in the year your rental property is first.

For book purposes you can determine your own useful life. Cost of Rs 150 less cumulative tax depreciation of Rs 90 ie. For laptops this is typically two years and for desktops typically four years.

Calculate Property Depreciation With Property Depreciation Calculator. The following chart contains the default year-to-year depreciation rates used by the Car Depreciation Calculator. You can use our depreciation calculator.

Vyapar depreciation calculator- Simplest online depreciation calculator for assetProperty etc using the SLM DBM methods. MACRS is the primary depreciation method used for tax purposes. If your computer cost more than 300 you can claim the depreciation over the life of the equipment.

Special depreciation rules apply to listed property. Heres the information you need to calculate depreciation. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

Prepared as per Schedule-II. Self-Employed defined as a return with a Schedule CC-EZ tax form. Residential rental property.

This lets us find the most appropriate writer for any type of assignment. 1 online tax filing solution for self-employed. Order a BMT Tax Depreciation Schedule BMT has completed more than 800000 property depreciation schedules helping Australian taxpayers just like you save thousands of dollars every year.

Enter an assets cost and life and our free MACRS depreciation calculator will provide the expense for each year of the assets life. Use our free tax preparation fee calculator to help you make an informed decision. Divide by 12 to tell you the monthly depreciation for the asset.

Report all rental income on your tax return and deduct the associated expenses from your rental income. Gain a proven solution for write-up AP AR payroll bank reconciliation asset depreciation and financial reporting. Computer component is classified as 5 year macrs property.

Depreciation rules for listed property. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. The Entity Selection Calculator is designed for Tax Professionals to evaluate the type of legal entity a business should consider including the application of the Qualified Business Income QBI deduction.

The number of years you expect to use the asset. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. By far the easiest though is bonus depreciation.

Bonus depreciation is automatic meaning you dont have to check any boxes or submit elections to get it. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300.

Depreciation rates as per income tax act for the financial years 2019-20 2020-21 are given below. Call our expert team today on 1300 728 726 or complete the form below to find out how we can help you maximise the deductions from your investment property. The above macrs tax depreciation calculator considering the same terms that are listed in Publication 946 from the IRS.

Feel free to change the rates as you see fit. Americas 1 tax preparation provider. Obviously youll want your tax advisor to weed through all the details and true to the tax code there are many.

Passenger automobiles and other property used for transportation. If you purchase a computer for. Tax Code which allows businesses to take advantage of accelerated depreciation as specified by the Modified.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. This is a new feature of the Tax Cuts and Jobs Act. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Computer software means any computer programme recorded on any disc tape perforated media or other information storage device. The calculation is based on the Modified Accelerated Cost Recovery method as described in Chapter 4 of IRS Publication 946 - How To Depreciate Property. If you own rental real estate you should be aware of your federal tax responsibilities.

To recover the carrying amount of Rs 100 the entity must earn taxable income of Rs 100 but will only be able to deduct tax depreciation of Rs 60. Get all the power of QuickBooks in a one-time purchase accounting software installed on your office computer. 1 online tax filing solution for self-employed.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Plus the calculator also gives you the option to include a year-by-year depreciation schedule in the results -- along with a. This calculator will calculate the rate and expense amount for personal or real property for a given year.

If you want to depreciate your computer youve got a couple of options. Section 179 Calculator. Useful life of the asset.

MACRS allows you to take a larger tax deduction in the early years of an asset and less in later years. You can choose High Medium or Low clicking a second time restores the defaults or manually change each years rate enter as percentages so for 28 enter 28. There are 4 pre-conditions on the under-300 full claim allowance.

Businesses in the US will also have to calculate depreciation based on the US. Email_capture Using bonus depreciation. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

The cost is less than 300. Your tax professional can help you work out the rate of depreciation you. Get all the power of QuickBooks in a one-time purchase accounting software installed on your office computer.

Office furnitureasset is classified as 7 year macrs property. For tax depreciation useful lives are based on the type of asset. A list of commonly used depreciation rates is given in a.

ABCAUS Excel Depreciation Calculator FY 2021-22 under Companies act 2013 latest version 0504 download. Section 179 deduction dollar limits. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20.

This lets us find the most appropriate writer for any type of assignment. It excludes vehicles that arent likely to be used for personal purposes due to their nature or design like. Consequently the entity will pay income taxes of Rs 10 Rs 40 at 25 when it recovers the carrying amount of the asset.

Total 1st Year Depreciation. Where the cost is more than 300 then the depreciation formula must be used to calculate the percentage tax deductible amount. Americas 1 tax preparation provider.

You can deduct the rental income.

Depreciation Calculator Depreciation Of An Asset Car Property

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Depreciation Formula Examples With Excel Template

Free Depreciation Calculator Online 2 Free Calculations

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Examples With Excel Template

Free Depreciation Calculator Online 2 Free Calculations

Free Macrs Depreciation Calculator For Excel

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Depreciation Calculator Definition Formula

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Accounting And Finance

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

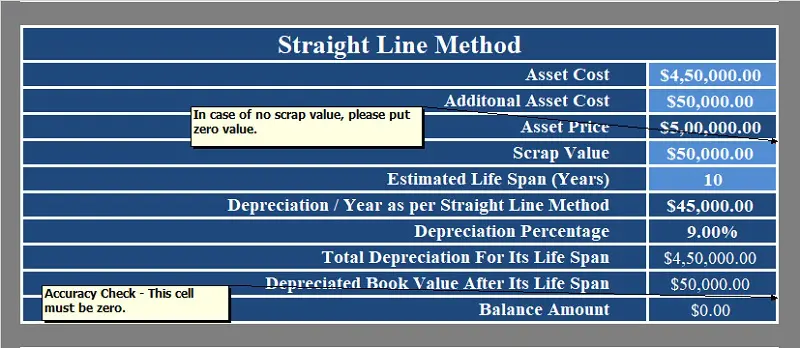

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs